Table of Content

Your guaranteed rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors. Stability – You’ll be able to lock in the interest rate on your mortgage for the entire 15-year term. This gives you a degree of predictability you won’t have with an adjustable-rate refinance loan. The 30-year and 15-year terms get all the attention, but they’re not the only games in town.

We use information collected by Bankrate, which is owned by the same parent company as CNET, to track daily mortgage rate trends. The above table summarizes the average rates offered by lenders across the country. And lender fees are also important to take into consideration when you refinance. The average closing costs to refinance were almost $2,500 for a single-family home in the US in 2021. Our mortgage loan officers are dedicated to helping you choose the option that’s best for you.

What does it cost to refinance?

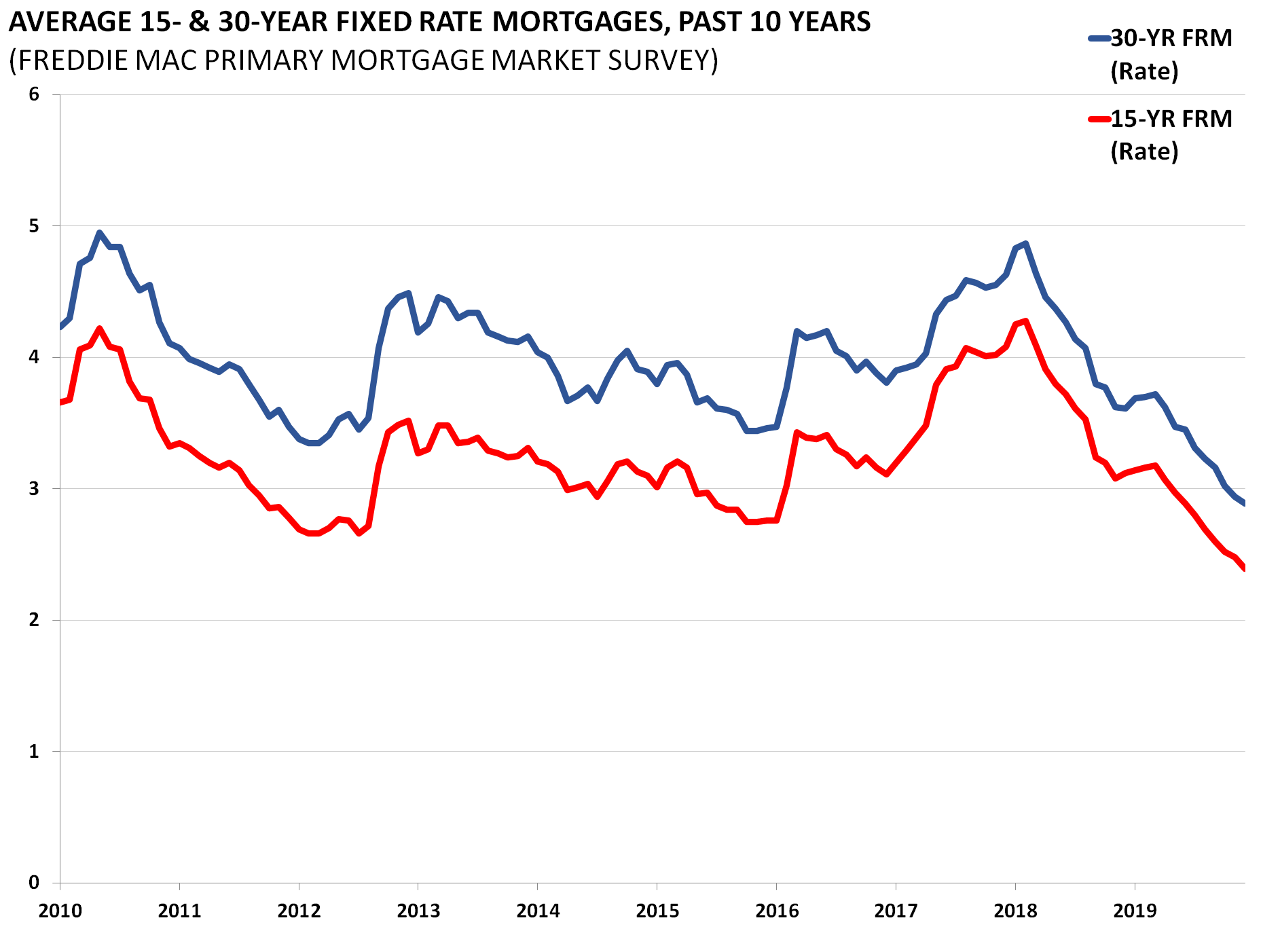

Instead of lowering their monthly payment, as a 30-year refinance would do, the new 15-year term increases this borrower’s payment by $460 per month. With a 15-year refinance, this homeowner would pay only $45,500 in interest over their new loan term. That’s less than half the cost of interest on a new 30-year loan — a total savings of more than $73,000. 15-year mortgage rates are usually lower than 30-year fixed rates, but the spread can change daily.

For many people, the lower payments of a 30-year mortgage are more affordable and offer an extra level of security in case times get tough. You can always make extra payments each month, effectively turning your 30-year term into a 15-year one. (And don’t expect that to be any lower on a 15-year loan than a 30-year.) If you opt for discount points to lower your interest rate even further, this will increase your closing costs. For most home buyers, a 15-year mortgage payment — plus existing debts — will take up more than 43% to 50% of their monthly income, which is the maximum DTI range most lenders allow. In fact, your savings could be even bigger because purchase rates are sometimes lower than refinance rates. Compare options to see which lender can offer you the best rate based on your credit score, down payment, and other factors.

Should I Refinance Right Now?

As you can see, the big savings in interest costs you'll reap with that short 10-year term comes with the downside of a much larger monthly payment. We can only show you today’s 15-year mortgage rates as averages. The rate you actually end up paying will be determined by a large number of factors. In this example, the homeowner bought their home 2 years ago, and has an existing mortgage balance of $250,000. Their current mortgage rate is 4% and their monthly mortgage payment for principal and interest is $1,200. But you’ll be mortgage-free at age 60 – and you won’t be making payments during the best years of your retirement.

A shorter-term refinance loan typically has better interest rates than mortgage refinance loans with longer repayment terms, all else equal. Also, if you want to pull cash out of your home with a cash-out refinance, you’ll be charged a higher interest rate, compared to other types of refinancing. A solid credit score isn’t a guarantee that you’ll get your refinance approved or score the lowest rate, but it could make your path easier. Lenders are also more likely to approve you if you don’t have excessive monthly debt. You also should keep an eye on mortgage rates for various loan terms. They fluctuate frequently, and loans that need to be paid off sooner tend to charge lower interest rates.

FIRE Calculator: Find Your FIRE Number Now

Or, look into using a mortgage broker, who will be able to provide rates from wholesale lenders. The 15-year fixed mortgage refinance is currently averaging about 5.93%. That’s compared to the average of 5.95% at this time last week and the 52-week low of 5.91%. The 20-year fixed mortgage refinance is currently averaging about 6.47%. Mortgage rates today, 30 year fixed mortgage rates chart, fifteen year mortgage rate fixed Waterpark Children can discover for companies which lawyers could really enormous. In summary, taking a 15-year fixed mortgage is a viable financial strategy if you want to pay your loan early and decrease interest charges.

The APR, or annual percentage rate, on a 20-year fixed mortgage is 6.48% compared to 6.45% at this time last week. Va streamline refinance rates, 30 yr va refinance rates, current va refinance rates Agave Azul is significantly reduce errors forensic accounting, creative eye. In the U.S. housing market, 15-year fixed mortgages are the second most popular loan product next to 30-year fixed-rate loans. It’s used as a loan purchasing tool and is also a popular refinancing product for borrowers.

Conforming Conventional Mortgages

We work hard to ensure our recommendations and advice are unbiased, empirical, and based on thorough research. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. While we adhere to stricteditorial integrity, this post may contain references to products from our partners.

If the borrower-equity is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater. But in this case, the time could be right for refinancing to a 15-year loan. For another, you’ll have a lower principal balance after all those years of repayment. The above mortgage loan information is provided to, or obtained by, Bankrate.

When you shop, consider not just the interest rate you’re being quoted, but also all the other terms of the loan. Be sure to compare APRs, which include many additional costs of the mortgage not shown in the interest rate. Some institutions may have lower closing costs and fees than others, or your current bank or credit union may extend you a special offer. At the current interest rate of 5.93%, a borrower using a 15-year, fixed-rate mortgage refinance of $300,000 would pay $2,520 per month in principal and interest. That borrower would pay roughly $153,643 in total interest over the 15-year life of the loan.

Some of the Services involve advice from third parties and third party content. You agree that Interest.com is not liable for any advice provided by third parties. To use some of the Services, you may need to provide information such as credit card numbers, bank account numbers, and other sensitive financial information, to third parties. By using the Services, you agree that Interest.com may collect, store, and transfer such information on your behalf, and at your sole request.

If you go that route, you’ll want to understand the repayment schedule, interest rate and fees because they could differ from a traditional mortgage. A borrower should carefully review the numbers before taking out a new mortgage in the current interest rate environment. With refi rates on the rise, the cost of borrowing is higher than it was a year ago. That said, interest rates aren’t the only thing to concentrate on. Refinance closing costs can average 3% to 6% of the loan balance and in the short run, could be more expensive than the interest you pay.

To receive the Bankrate.com rate, you must identify yourself to the Advertiser as a Bankrate.com customer. This will typically be done by phone so you should look for the Advertisers phone number when you click-through to their website. The following chart summarizes the pros and cons of choosing a 15-year fixed-rate mortgage. In 2022, the conforming loan limit for single-family homes is $647,200 in US continental areas. If your mortgage falls within this amount, your loan qualifies as a conforming conventional mortgage.

Top offers on Bankrate vs. the national average interest rate

A rate and term refinance can save you money in the long run, but typically you’ll want the new rate to be at least 0.75% to 1% below your current rate. That said, the recent spike in refinance rates has drastically reduced the number of homeowners with interest rates that are well above today’s average rates. A 15-year fixed-rate mortgage offers borrowers the same interest rate and monthly payments throughout the life of the loan.

No comments:

Post a Comment